So we published this in our newsletter, but wanted to also share our thoughts here.

This was a challenging piece to write, and one that certainly is short on answers and long on opinion and supposition.

As a company, I want Vintality, to be a positive and useful place for our industry. And I also want us to be able to talk openly and honestly about our industry. I really want Vintality to be a hub of resources and tools that really improves our industry by helping the people and winegrowers that make it.

And yet the reality is, we’re in the middle of a rough period. I think it’s important to acknowledge this, without catastrophizing. It’s important to talk about it because (a) people need to know they’re not alone and (b) we all need to factor in this reality to our planning.

So that’s what I want to talk about this newsletter. Not because everything’s terrible (it’s not) but because this is the topic I’m hearing the most from clients and colleagues, and I feel its helpful to share that sentiment. It’s the number one conversation I’m hearing across BC (in the wine industry).

I also have to say, this is just opinion, rumour, and my own thoughts. Disagree away (and send me an email or call me if you do!)

What's Going on in BC?

First of all, we’re heading through a period of bankruptcies and quick sales. We’ve seen Blue Sky, Sumac Ridge, Kitsch and now Red Rooster shut their doors. There may be a couple of more before the year is out.

We’re also seeing more wineries go up for sale, and likely will sell at prices that are quite a bit lower than they would’ve sold for a year ago. I’ve heard 40, 70 or 100 wineries are currently for sale. And I’ve heard from clients a couple of surprising wineries that are being discreetly shopped around.

This is purely supposition on my part, but with land prices and local demand (more on this later) we likely passed a peak in land prices. In part because I don’t know who is going to purchase these wineries at 2021/22 prices.

There may be an exception on Vancouver Island (we’ll see) where the Jackson Family’s purchases have driven up winery prices locally. In part, because there is perception among some locals Jackson wants to be buyers again.

This actually gets us to one interesting data point – the Jackson Family did not invest in the Okanagan because they believed land prices were too high for them to make a profit. They looked, just didn’t buy. Are Vancouver Island prices also getting too high? I’ve also heard from another foreign company that they’ve avoided buying in the Okanagan as they haven’t seen a path to profitability.

The challenge of course is a change in the international market, BC market, and climate conditions. I’m hearing yields are down as much as 80%+ in parts of Oliver and Osoyoos,, worse in the Similkameen. Other areas like OK Falls and Naramata seem to be down only 10-20%. But the fruit quality I’m suspicious of, given the extreme stress the vines experienced, and of course… smoke taint. There’s smoke everywhere this year.

This is a huge economic challenge for us and it’s pushing some wineries to the max. Tack on rising interest charges affecting debt… Like I said above, it’s very difficult. And for many people this is their livelihood. It’s hard.

How About the Big 3?

I’ve also been hearing some very interesting rumours that the “Big 3” are significantly changing how they operate. Keep in mind, these are just rumours (the fun kind), but what I’ve heard from a few people is twofold:

- There is less of a priority on selling wine in BC.

- There is a move towards the “Cellared in Canada”.

In the first case, my understanding (of the rumours) is that there is just not enough demand for premium wine in BC and for these companies to grow – it has to happen outside of BC. There is both a slackening of demand internationally for wine (particularly among Millennials / Gen Z) and an even stronger slowing in the Okanagan.

Part of this may be temporary – I heard from a few friends and family that they avoided travelling for fear of vacations being ruined by forest fires. This was before our actual fires, amusingly. And this was echoed by some friends who rent out vacation homes here – who also have seen a real slow down this year. So it’s not just a wine thing in the Okanagan – tourism is down across all industries. Optimistically, if we get better at forest management and/or invest more in forest fighting (or just get lucky) this perception may disappear.

But the belief may be that with the quantity of wineries in BC, particularly given all the purchasing that the Big 3 have been doing, we’ve hit a ceiling for premium wine demand locally.

On top of which, my understanding is that the big gap for the Big 3 is under-production. That is, given their scale, labour costs, and winemaking capacity they have too few grapes. Which again impacts what is in demand – vineyards, not wineries. As one person told me: “Our equipment is better, our brand is better, we just need grapes.” So this might explain why wineries like Foxtrot are now offering their vineyard for sale only (no brand, no equipment).

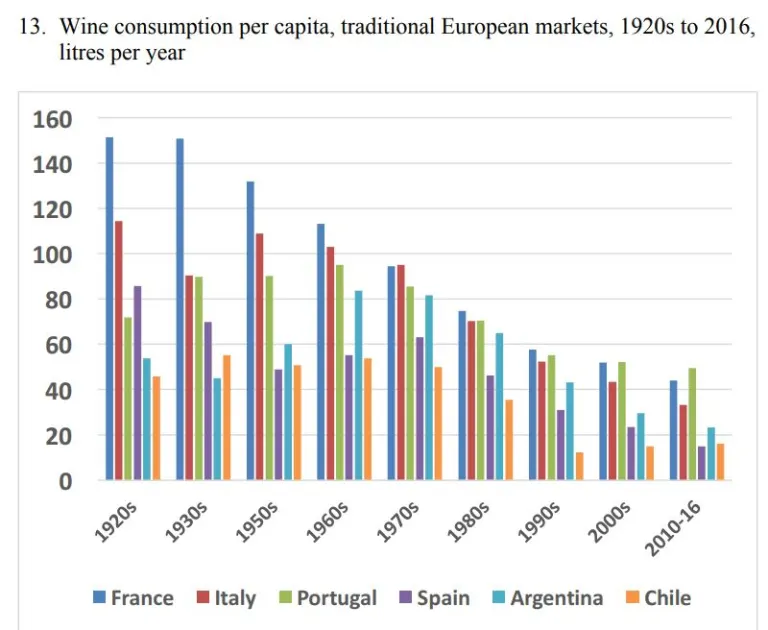

To the second point, and on the other end of the spectrum, there is apparently a push to used the “Cellared in Canada” label to import cheap wine (I’m guessing South American) to allow BC wineries to compete at the sub-$20 mark.

I get the business case – after all we’re all running businesses here. Unless you have big pockets behind you, you’re having to make decisions in part based on numbers. But I think this is a mistake which might help the big companies who pursue it but will hurt the rest of the industry. I’ve already heard from a couple of non-industry people who did not realise that “Cellared in Canada” was different than other Canadian wine. And the wine was “shit”, so they skipped BC and when they wanted cheap wine went to Chile.

Something needs to change. It may be a matter of waiting some of this out and buying up more BC wineries at better prices, or moving to try and capture the bottom of the market. I don’t know, but the Big 3 are facing similar realities as the rest of BC and we’re seeing this reflected in how they’re managing their brands (including closing some).

And Internationally?

The BC wine industry has definitely benefited from a fairly protected market here. Now, that may be changing (for reasons to do with NAFTA and local economics).

Interestingly, this may be coinciding with conditions in the global wine market.

I don’t want to spend to much time on it because Mike Veseth has penned two excellent pieces on what seems to be happening.

He captures it well:

So this theory argues that changes in the economic nature of wine consumption combined with changes in patterns of and expectations for economic growth can help explain many important trends in global wine consumption, including both recent premiumization patterns and the sudden decline in purchases by aspirational consumers.

This economic theory obviously isn’t the whole story when it comes to explaining the global wine glut, and it intersects with the generation gap theory in some respects since many younger people are the “aspirational consumers” who find that economic conditions have taken away some of their hoped-for prosperity. They’ve cut back aspirations for wine (and home ownership and paying off college debt and …) as inflation and slow growth put on the squeeze.

Is this the whole story? Of course not. But it is important to consider that the economic decision to purchase wine (or not) is affected by economic conditions. The best thing for wine, in this framework, would be a return to a more prosperous global economy and that is not something the wine industry can accomplish on its own. So the wine industry has an enormous stake in efforts to bring inflation under control and return key economies to a stable growth path.

In the meantime, I suspect we will see even more consolidation in the wine sector, with large players expanding and fine-tuning their portfolios to prepare for future growth while small producers (and most wineries in the U.S. are very small) seek out aspirational and luxury buyers in local markets.

*Hypothesis Alert*

A slight digression on where this may be going.

My own opinion is that land prices have gotten too high, squeezing out a new generation of winemakers and growers we need to keep pushing our industry forward. Rather than a number of innovative farmers/winemakers starting their own winery or vineyard, they become employees. As employees, they move around every few years and don’t develop the dedication and knowledge to a specific site.

It’s this dedication and knowledge from our older generations that have brought the BC wine industry to the prominence it currently has. But for it to keep evolving and changing, we need the next generation to have similar opportunities. And they do not.

I can’t tell you the number of talented, young farmers and winemakers I’ve talked with who had plans to start their own vineyard/winery, but have abandoned it due to the million dollars needed for a few planted acres.

On top of which, foreign consultants and employees get brought in, last a couple of years, and go back home to Australia or France or California. It’s like clockwork. It’s great that new ideas and talent is brought in! This is critical for the BC wine industry. But we need these talented people to stay, and marry their expert knowledge with knowledge of the local. That takes time.

Can We End on Positive News?

Why yes we can!

I have THREE positive things to say. Three!

One.

“And so it should be, that we spend our lives in the everyday bustle,

Trying to be in agreement with the line of our fate.”

-Czeslaw Milosz-

Things go up, things come down. There’s an element of melodrama to my writing above. This happens. Wineries go bankrupt even in the best of times. Demand falls, nothing keeps going up forever. It may be a small blip, or none at all. I’m no prophet – even with the beard.

This is life. Uncertain. Sometimes cyclical.

This is a major reason why I love reading history and biographies so much. It places everything in context. I just finished Cormac McCarthy’s Blood Meridian, a fictional work based on the real Glanton gang. Let me tell you, I’m very happy in my warm and quiet home.

“Courage is the measure of our heartfelt participation with life, with another, with a community, a work; a future.”

-David Whyte-

Two.

If prices do drop, there will be lots of opportunity. We’ve seen vineyards pushed to more and more marginal sites – and a mountain destroyed.

Warren Buffett claimed he made his money in the downturns. If there is one, there’s opportunity. If you’re well positioned, it could be a time of expansion.

It also could be a time to try new things. Schopenhauer’s “creative destruction”. A mentor of mine once gave me excellent advice I’ve never forgotten – “every problem is an opportunity”. I have to fight to live by it, but I think it worth it.

“What is the most revolutionary way to change a society? Violent revolution? Gradual change? Neither. If you want to change society, then you must tell an alternative story.”

-Ivan Illich-

Three.

If land prices do come down at a more sustained level, if we do see a significant shift in the industry, we will have pain in the near future. It is going to really suck for a lot of people (us included).

But my hope that we will see a long term benefit though.

At 2022 prices, it’s hard to make an economic argument for a lot of (not all) winery and vineyard purchases. The sale volume and margins for most (not all) brands aren’t high enough. And of course, a major reason is because of the cost of land (and interest on top). And so wine list prices get pushed higher, pricing out more of the market.

Reduce that – and not only can more people purchase land, but those that do have more balanced accounts. I would even hope it allows the next generation of farmers to get into the market.

We’ll see.

Let’s end on one of my favorite poems, from one of Czeslaw Milosz’s last poetry collections as he meditates on life, on change, on death:

“Not soon, as late as the approach of my ninetieth year,

I felt a door opening in me and I entered

the clarity of early morning.”

The clarity of early morning.

One Response

Interesting take on cellared wines. I have had the misfortune of tasting TEXAS wine. This is a wine with 20% texas grown grapes and the rest is an assemblage of of other grapes from around the world. Chilli, Argentina, Spain, Portugal and Italy. Its expensive and tastes awful I am sorry to say.

There are Texas wines that are 100% made with homegrown grapes but at over $100 per bottle, thats a lot to pay for a wine thats mediocre at best.

I would not recommend using grapes from a foreign country for the risk of losing the BC identity. I have tasted BC wine and found it most enjoyable compared to a lot of new world wines. The wines I tasted were from large and small producers.

I am looking forward to coming back to BC and trying some new wines.